DeFi, or decentralized finance, is positioned to restructure the world’s financial ecosystem. Here’s how æternity is empowering developers and building the foundation of the DeFi revolution.

DeFi, or decentralized finance, is a collective term used to refer to the application of blockchain technology in the world of traditional finance.

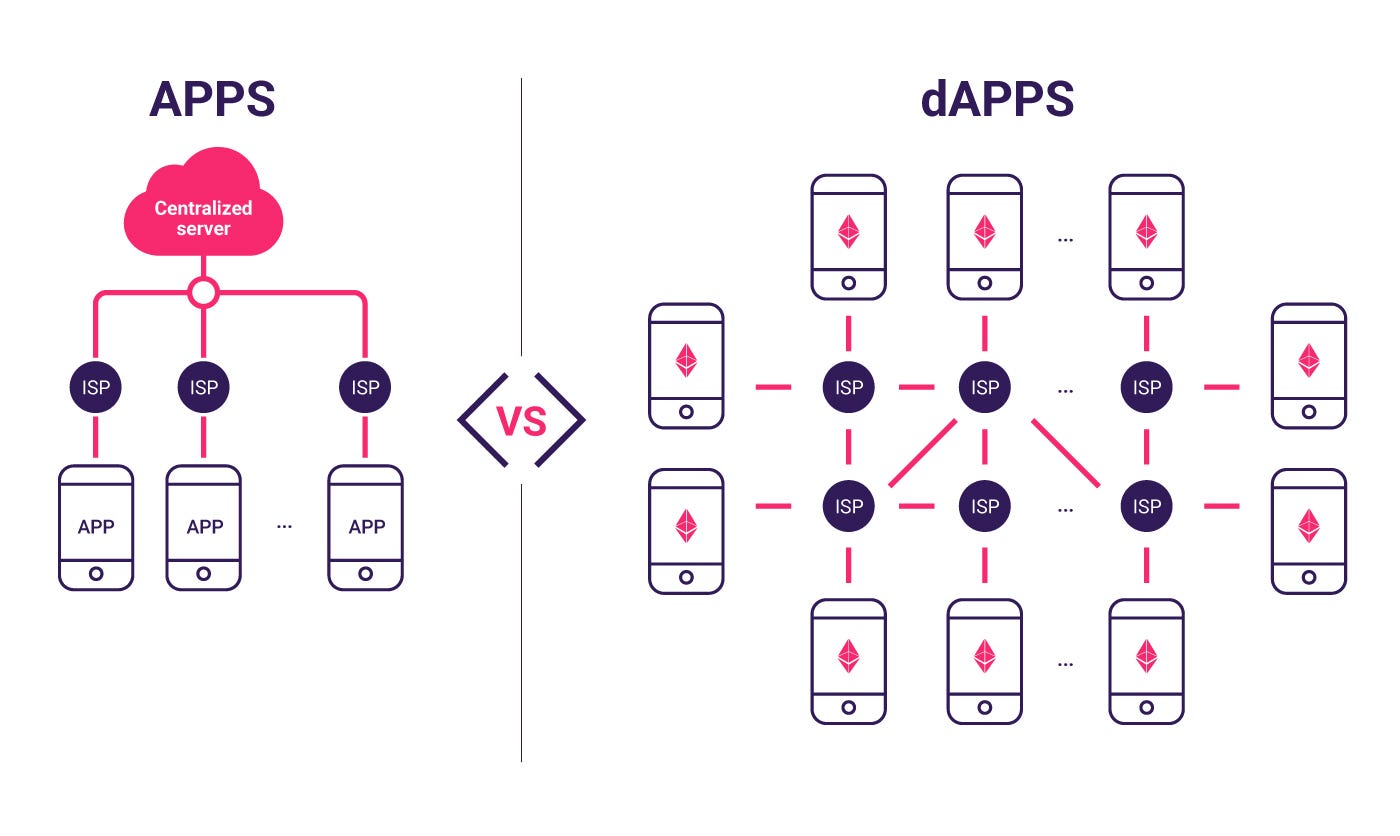

The core axiom of DeFi rejects the centralized nature of traditional finance and banking institutions, with DeFi platforms and developers working to recreate traditional financial infrastructure on decentralized applications or peer-to-peer architecture.

The core goal of DeFi is to wholly reconstruct the traditional banking system in an open, permissionless way – but the journey toward truly decentralized finance is obstructed by significant roadblocks that must be overcome.

Some of the most prominent obstacles faced by DeFi developers and enterprises are issues such as smart contract vulnerability, governance, user error, scalability, interoperability problems, and the relative difficulty associated with DeFi development.

æternity solves the problems present in the current DeFi ecosystem, delivering a scalable, secure, and decentralized platform ideal for creating DeFi apps.

æternity delivers robust smart contracts, faster virtual machine architecture, Oracle-driven interoperability, dynamic governance, infinite scalability, and streamlined development tools.

Here’s why æternity is the best blockchain for DeFi projects.

The Problem With DeFi: What æternity Solves for Developers

The æternity approach to application development and deployment addresses the problems faced by blockchain developers in the defi ecosystem – specifically smart contract vulnerabilities, user error in development, interoperability, centralization, and scalability.

The DeFi revolution is built on the foundation of smart contracts – code operating on blockchain that executes automatically when specific conditions are met. Smart contracts allow for the creation of dapps, which can be designed to create stablecoins linked to fiat currencies, facilitate lending or borrowowing on a peer-to-peer basis, or even replace traditional banking services such as mortgage issuance or insurance.

Smart Contract Security

The core issue with smart contracts is security. Smart contract vulnerability is a very serious threat to any DeFi project. A dapp built on smart contracts with unidentified code flaws can result in large-scale capital losses, such as Ethereum’s 2016 DAO hack, caused by smart contract vulnerabilities that resulted in the loss of 3.6 million ETH.

User Error

The threat of smart contract vulnerability is closely linked to another obstacle faced by DeFi developers: user error. Developer tools for smart contracts and decentralized applications can be complex, limiting the oversight developers have over their code and preventing them from anticipating potential interactions between their dapps and users.

Scalability Limitations

The rate at which DeFi solutions are adopted by the market are intrinsically linked to the scalablity of the blockchain networks they operate on. DeFi dapps are designed to provide financial services for potentially millions of users – necessitating blockchain architecture that can keep up with demand.

Blockchain update timing issues present critical problems for DeFi dapps at scale. Traditional finance ledgers operate speeds several orders of magnitude higher than the 15-second state updates of contemporary blockchain networks.

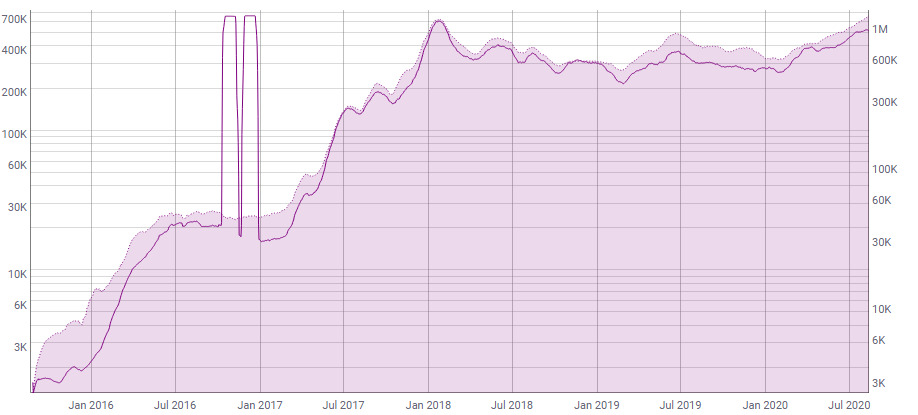

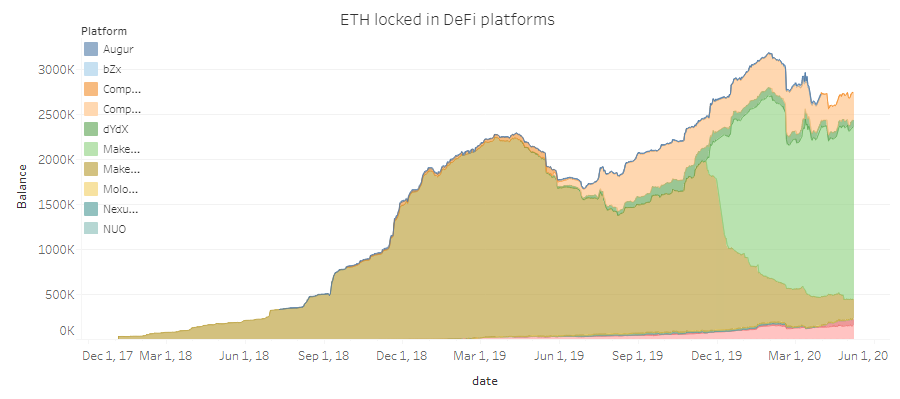

The Ethereum network, for example, is subject to congestion issues during high use periods, limiting the rate at which DeFi platforms operating on the network are able to scale. The number of active addresses on the Ethereum blockchain and transaction count, outlined in the graph above, reflect the rate at which ETH is locked up in DeFi smart contracts on the Ethereum blockchain, illustrated below.

In order to succeed and compete with the traditional centralized financial ecosystem, DeFi dapps demand blockchain networks that deliver high transaction throughput and capacity, with affordable transaction costs.

Interoperability

The DeFi ecosystem is defined by openness and interoperability, allowing different blockchain networks and smart contracts to communicate with each other in order to perform functions such as atomic swaps.

The interoperability needs of DeFi applications also extend off-chain, with future DeFi platforms likely to require oracle solutions in order to remain complaint with regulation governing Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

Contemporary blockchain networks lack the interoperability functionality required by robust DeFi applications or, by creating dependencies with centralized third parties, introduce key bottlenecks that rely on centralization in order to function.

What Does DeFi Need to Succeed?

The core design principles of æternity establish it as the ideal platform for DeFi development. The æternity blockchain provides a rich feature set that delivers the key tools necessary to create and deploy global-scale decentralized applications, solving the security, user error, scalability, and interoperability obstacles presented by contemporary blockchain networks.

A blockchain ecosystem suitable for global-scale DeFi applications demands five separate layers working in concert to establish a wholly decentralized, scalable, interoperable ecosystem – the settlement, asset, protocol, application and aggregation layers.

- The settlement layer is the blockchain and the native protocol asset – in this case, the æternity blockchain and AE token. The settlement layer is the foundation of trustless execution, ensuring that state changes are performed in line with the rules of the blockchain.

- The asset layer contains all tokens issued on the settlement layer, including the native protocol asset – AE tokens – any any other tokens created using token standards supported by the æternity blockchain

- The protocol layer provides standards that are used in specific use cases, such as decentralized exchanges, decentralized finance platforms or debt markets, or on-chain asset managements. These standards are implemented through smart contracts – a key stumbling point for DeFi applications built on other blockchains. These standards must be highly interoperable.

- The application layer exists as user-oriented applications such as web browser based front ends, allowing users to interact with and use the protocols specific to an application.

- Lastly, the aggregation later extends the functionality of the application layer, creating user-focused platforms that connect multiple applications and protocols. The aggregation layer adds complexity to the DeFi ecosystem, allowing users to easily find and combine information or perform otherwise complicated tasks such as comparing rates and services.

How æternity Empowers the Next Generation of DeFi

æternity provides a robust, secure, and scalable solution across all layers of DeFi architecture through five key features:

- The Sophia smart contract language which, alongside intelligent editor tools, makes composing correct, secure smart contracts simple and efficient. Deloitte data highlights the importance of smart contracts to the future of decentralized finance via Deloitte CFO insights.

- The FATE Virtual Machine, delivering automatic error minimization and establishing a safer, simpler, and easier programming environment

- æternity Oracles, which allow for the integration of real-world data into blockchain applications and DeFi use cases. Binance, the highest-volume cryptocurrency exchange online, provides a detailed breakdown into the importance of oracles in blockchain – as well as listing æternity’s AE token in multiple pairings

- Advanced state channels that facilitate off-chain smart contract execution

- Hyperchains, unique hybrid consensus child chains that provide infinite scalability, low-cost accessibility, and security in order to allow any platform to create high throughput public or private networks for DeFi applications

æternity delivers intelligent smart contracts executed via a highly efficient VM, with infinitely scalable hyperchains allowing developers to rapidly create and deploy DeFi applications.

Importantly, the interoperable nature of the æternity protocol layer allows DeFi developers to integrate complex standards in order to create purpose-built applications that are compliant with regulatory frameworks.

æternity provides more functionality for DeFi applications than other blockchain networks such as Ethereum – for 1/100th of the fees, and much, much faster.

Building DeFi Applications on æternity

Æ Studio. provides developers with a highly innovative, easy-to-use development Web-IDE for composing applications in the Sophia smart contract language – Æ Studio.

Æ Studio allows developers to bypass trial and error implementation processes or lengthy documentation study, delivering real-time collaborative features and tools that allow users to generate fully-operational decentralized applications on the fly.

To learn more about Æ Studio, take a look over the Æ Studio release announcement via the æternity crypto foundation blog, or navigate directly to Æ Studio and start experimenting.

The streamlined development tools provided by æternity also allow developers to rapidly create and deploy Hyperchains – application-specific child chains that operate on a hybrid Proof of Work/Proof of Stake consensus model.

Hyperchains allow developers to solve the scalability problem that inhibits the development of large-scale DeFi applications. Hyperchains can be deployed privately or publicly, and can be stacked endlessly to create infinite scalability, limiting or extending the protocol layer in accordance with the specific needs of any DeFi app.

æternity DeFi Use Cases

The potential DeFi use cases presented by æternity are limitless. æternity improves upon many areas of blockchain technology, overcoming the limitations of existing blockchain networks and opening the door to truly decentralized finance through features such as:

- Hybrid PoW/PoS consensus, facilitating rapid state changes

- Off-chain smart contract execution through state channels

- Built-in oracles that provide access to real-world data and external APIs

- A user-friendly naming system that provides human-readable identities to oracles and user accounts

- Infinite scalablity through Hyperchains

- Error minimization through intelligent development tools

æternity presents developers with an intuitive, highly functional ecosystem in which to create a broad spectrum of robust, scalable DeFi applications, such as:

- Asset tokenization, including non-fungible tokens and stablecoins

- Synthetic assets such as crypto-based CFDs

- Insurance and insurtech applications

- Decentralized exchanges, with complex functionality such as margin trading

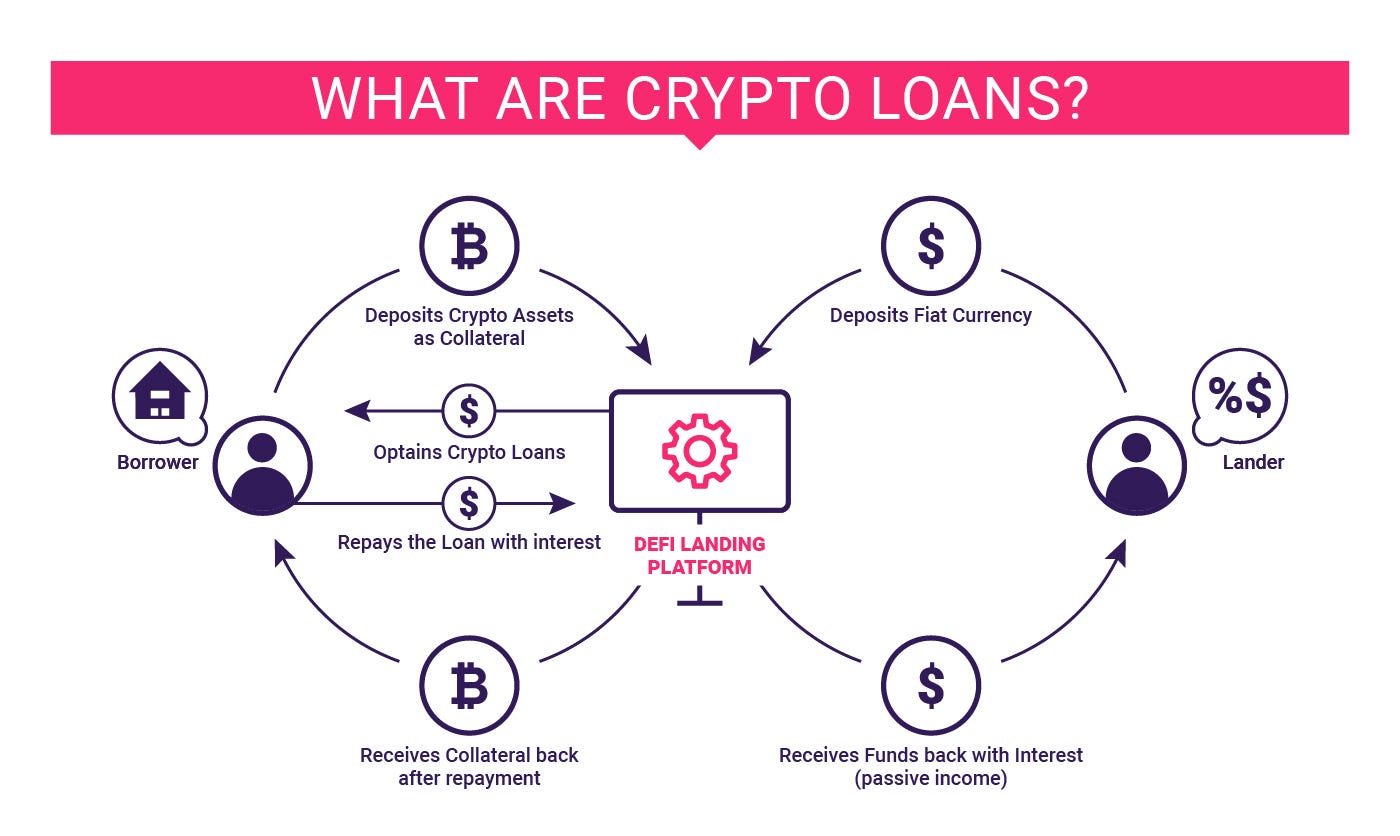

- Decentralized finance, lending, and borrowing, or crypto-backed loans

- Automated cross-chain token swaps (atomic swaps)

- Prediction markets

Who is Already Building DeFi Solutions on æternity?

The æternity ecosystem is already home to a wide range of decentralized applications and DeFi projects that are using æternity technology to revolutionize the finance sector.

Superhero is a censorship-free, decentralized social tipping platform that allows users to send tips to anybody online, with no additional fees. Supehero uses æternity technology to make blockchain technology and payments accessible to the average internet user.

Jelly Swap is one of the first DeFi platforms to integrate æternity technology, providing users with the ability to execute peer-to-peer atomic swaps across different blockchain networks.

Assetify is a peer to peer lending platform, using æternity technology to deliver a turnkey solution aimed at p2p lenders and fintech companies focused on entering the digital asset market.

SmartCredit leverages the scalability of the æternity blockchain to provide crypto-backed crypto loans to individuals seeking finance, as well as a Credit as a Service API to crypto platforms.

UTU builds on æternity to tokenize trust, using digital trust models in order to minimize over-collateralization and trust issues present in the DeFi space. By combining æternity technology with machine learning, social graphs and oracles, UTU creates stronger relationships between borrowers and lenders in decentralized finance.

The æternity DeFi ecosystem consists of over 30 different projects and applications, connecting hundreds of developers and hundreds of thousands of users around the world in order to create the decentralized financial ecosystem of the future.

Launch Your DeFi Project With æternity

æternity provides an efficient, cost-effective, accessible and transparent framework for the new DeFi ecosystem. By establishing new standards for DeFi application development, scalability, and security, æternity functions as the best platform available for DeFi use cases and opens the door to the future of decentralized finance.

To learn more about building on æternity or dive into the world of æternity-enabled DeFi, head over to the æternity forum, the æpp development community, or check out the latest æcosystem project introductions.

Interested in æternity? Get in touch:

GitHub | Forum | Reddit | Twitter | YouTube | LinkedIn | Telegram

Leave a Reply