In a world of information, misinformation is a powerful weapon.

Have you ever heard of the “Citizens United” decision by the US Supreme Court? The chances are that you haven’t, even if you are an US citizen. That ruling, however, is one of the more important events in the history of democracy and remains highly controversial to this day. It reveals how ruling elites are adapting to the conditions of the age of information and provides a blueprint for how to manage democracy today.

The Citizens United ruling, released in January 2010, gave the green light to corporations and labor unions to spend as much as they want to convince people to vote for or against a candidate (1). It ruled that political contributions are a form of free speech and outside groups can spend unlimited amounts of money to influence voters. Media expenditures skyrocketed. The dam walls protecting US voters from the ocean of information and misinformation broke.

The most fervent, global protector of the idea of democracy – the United States—confirmed that:

Information is not so dangerous, if you have the means to produce unlimited amounts of it.

All that was before the 2016 presidential campaign.

Too Much Input. Cannot Compute.

I will refrain from addressing politics too much. It is simply an important sphere where significant amounts of capital are being converted into arguments, ideas and emotions. It is most definitely not the only field where this is happening. I am confident that you have noticed that:

We are all drowning in information.

If there is a feature that marks our global society today, that is our love/hate relationship with information. We produce exabytes of it every day and yet it is hard to make a judgement on its overall effect. Does more information makes us happier? Does it make is more informed? Or does it confuse us and leads us to exist in our own informational bubbles, unable to see the larger picture?

What we have to deal with today is “information overload”. It is a term used to describe the difficulty of understanding an issue and effectively making decisions when one has too much information about it (3). It is affecting individuals, companies and governmental organizations alike, leading to prolonged indecision in times when quick reactions are required. With so many options, opinions and real or imagined facts, how is one supposed to take the right decision? What can we do?

Who Filters Your Information?

Two big names immediately come into mind – Facebook and Google.

Almost 2 billion people use Facebook today. One of the most important services that it provides to its users is personalization of information or “filtering” based on complex profiling. Facebook’s Newsfeed Algorithm helps you be exposed only to content relevant to you.

That’s great, right? Well, as usual, there are two sides to this. What happens when you only see what you want to see is that your worldview or position on various issues get entrenched. Without realizing it, we develop tunnel vision. Rarely will our Facebook comfort zones expose us to opposing views, and as a result we eventually become victims to our own biases (4).

Moreover, you could unknowingly be exposed to manipulations. The Guardian and the Observer have recently presented evidence of Google’s search algorithm and its autocomplete function prioritizing websites that declare climate change a hoax, being gay is a sin, and the Sandy Hook mass shooting never happened (5).

What can you do? With so much information floating around and our most relied on filters being subject of controversies, who can you trust?

Put Your Money Where Your Mouth Is

I am sure you have all heard this popular expression. It relates to the idea that “talk is cheap”, a statement that is infinitely more valid in our internet-based, social media-led virtual society.

Will the so-called “internet trolls” exist in such numbers today, if they had to pay for each of their controversial comments? Will you continue receiving hundreds of spam messages per year, if e-mails had a cost? Surely, the answer is not “No”. There will always be groups willing to convert cash to information. However, the volume of data would definitely be reduced.

What if there is way to allow everyone to express their opinion and profit from being correct? You think OneCoin will replace Bitcoin as the dominant cryptocurrency? Are you so confident as to bet, for example, 5 BTC? No? Well then, keep your opinions to yourself – they obviously lack the necessary conviction. Or alternatively – “Yes”. Even better. Losing 5 BTC can have far reaching therapeutic effects on the individual.

Markets are Excellent Sources of Information

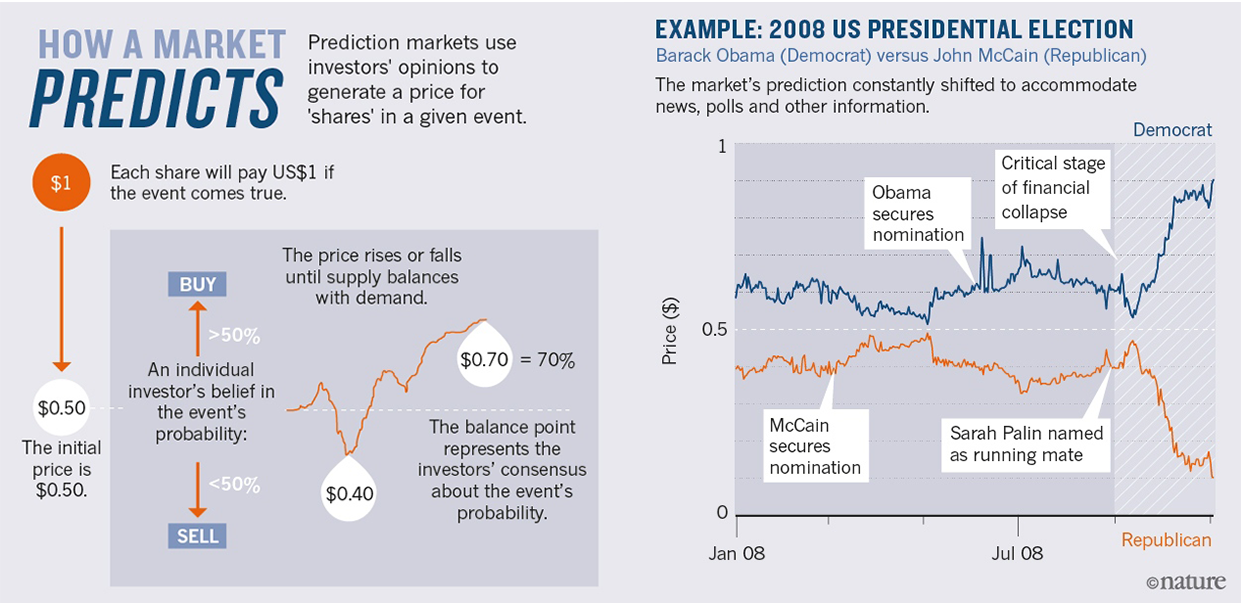

Betting or creating a market on a certain subject, creates a source of information on that subject that expresses beliefs, backed by value. One can use the price as an indicator of probability, 0.5 USD representing a 50:50 chance. Have a look below:

Another noteworthy advantage of markets as informational sources is the fact that they are flexible enough to accommodate any new information as soon as it becomes available.

Markets are most definitely NOT a perfect informational source due to the presence of human emotions – greed and fear being the most referenced ones in this context. However, they have been proven to produce the best possible data (or being an equivalent) in the imperfect environment that we all live in (6).

Markets are the red pill to the “information overload” condition we all suffer from.

Prediction Markets – the Best Information Filters

Interestingly, this is not something new. Markets to bet on the outcomes of future events have existed for a long time, and elections in particular have a long history as their subject. Public and open political betting dates back to George Washington’s election, and organized election-betting markets have existed since the 1860s (6). Here is a popular quote from Andrew Carnegie made in 1904:

“From what I see of the betting . . . I do not think that Mr. Roosevelt will need my vote. I am sure of his election.”

Politics, again, is just the tip of the iceberg. Prediction markets have also produced high quality information to questions like:

- Whether the Higgs boson particle would be discovered.

- Whether Lebron James would sign to play for the New York Knicks.

- Will AlphaGo beat Ke Jie in the three-game match planned for May 2017?

- Will bitcoin top 1900 USD before June 1, 2017?

Furthermore, prediction markets have been implemented in the internal decision-making processes of various well-known companies such as: Hewlett-Packard, Siemens, Best Buy, Chrysler, Electronic Arts, Intel, Microsoft, Motorola, Nokia, Pfizer, Qualcomm, TNT, and General Electric. Even the National Intelligence Agency of the United States (CIA) has produced a study that confirms the informational value of prediction markets.

So far, however, prediction markets have existed only in “controlled environments”. Think of your local bookie. They create the markets by asking the questions and setting the odds. More open versions such as Fairlay, which uses bitcoin, are centralized which does not provide the necessary level of security to users. Finally, cryptocurrencies are yet to enter the mainstream or even circles of experts that can provide valuable, highly specialized information. For these reasons the use of prediction markets as filters of data has so far been restricted.

Permissionless Prediction Markets on a Blockchain

Can you imagine a global platform that allows anyone to make a claim/ask a question about anything, set the odds and bet? Decentralized systems where innovation can happen without permission have allowed new (& old ideas) to flourish in wondrous new ways (7).

At æternity, we believe that prediction markets will be re-discovered as sources of clarity in a world of exuberant informational surpluses.

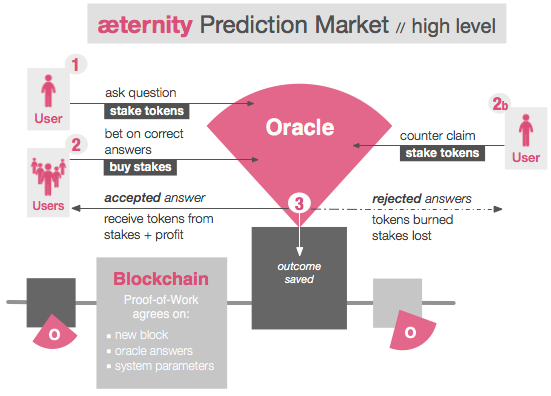

The primary advantages of æternity, as a blockchain platform enabling prediction market applications, is derived from its implementation of state channels and oracles.

Smart contracts in state channels are perfect for microservices on the web that require a high transaction throughput.

State Channels

A global prediction market needs to be scalable, secure and cheap to use. However, certain security solutions that could enable peer-of-peer value exchange require high-transaction volume. A good example here is the “Free Option Problem“. One of its possible solutions is to divide the value transfer into increments. For instance, a trade of 100 bitcoins can be broken into 10 000 trades of 0.01 BTC. This fix, however, could only be realistically implemented in a system that allows high-speed value transfers.

At æternity participants have infinite instant transactions, limited only by the speed of light.

Oracles

A prediction market will not be created at all, if there is no way to settle the outcome. One cannot bet on the volume of rain that has fallen on an area before a certain date, if there is no way to acquire that information subsequently. There is a need for an “oracle” or a way for information to flow into the blockchain.

æternity presents a highly scalable blockchain architecture with a consensus mechanism which is also used to check the oracle.

Simply put: every time a decision resolves in a prediction market, the blockchain forks. One side decides that the decision’s outcome is “true”, the other decides “false”. The fork with more hashpower is considered the “truth” and can be used to feed prediction markets, deciding their outcomes.

This straightforward oracle mechanism has a big drawback, however. There is a large cost to having users manually provide input to each oracle decision, especially having in mind that an attacker could spam the network with questions. The solution is to make oracle spam expensive. If an attacker wants to spam the blockchain with questions, he will also have to make large, potentially losing, bets in the market. These losing bets cover the cost of other users having to manually answer the questions (8).

Re-Imagining Prediction Markets

The social value of prediction markets is yet to be realized to its full potential. We believe that open, decentralized systems will be at the center of the re-discovery of this valuable source of information and will help people globally make more informed decisions in various aspects of their lives.

Interested in our blockchain architecture? Visit our website and subscribe for updates. Join the conversation at Telegram.

GitHub | Reddit | Twitter | Facebook | Mail

References:

(1) Dunbar, John. The ‘Citizens United’ decision and why it matters. The Center for Public Integrity. Updated March 2016. URL

(2) Walker, Ben. Every Day Big Data Statistics – 2.5 Quintillion Bytes Of Data Created Daily. VCloudNews. April 2015. URL

(3) Wikipedia Article. Information Overload. URL

(4) El-Bermawy, Mostafa M. Your Filter Bubble is Destroying Democracy. Wired. November 2016. URL

(5) Solon, Olivia & Sam Levin. How Google’s Search Algorithm Spreads False Information with a Rightwing Bias. The Guardian. December 2016. URL

(6) Ozimek, Adam. The Regulation and Value of Prediction Markets. Mercantus Center at George Mason University. March 2014. URL

(7) Rouviere, Simon de la. Why & How Decentralized Prediction Markets Will Change Just About Everything. ConsenSys Blog. December 2016. URL

(8) Hess, Zackary. Oracle Simple. GitHub Repository. January 2017. URL

Leave a Reply