Blockchains excel in trust management and transparency. Any bells?

The entire global insurance market is based on trust management. The process of creating an insurance contract evolved through the centuries, aiming to sell “peace of mind” to anyone with doubts about the future. A simple human interaction – the giving of a promise – slowly became “institutionalized”. The verbal commitment, although never broken by chivalrous men, was simply not in a position to accommodate the complexity of relations between parties with unknown moral stature. In time, “one’s word” became a source of protection only in small, closed communities, while insurance acquired the status of financial product and began to heavily subsidize the pulp and paper industry.

Today, the insurance industry collects around $5tn a year in premiums(1). One can ensure anything and any risk that can be measured, can be reduced by a promise of payment. However, much like other industries that have accompanied human societies on their path of political, economic and social evolution, the insurance sector has yet to make full use of modern technology. The ripples created by interconnected, computational devices reached the ancient bastions of promise formalizers, but their effects were not as profound as in other sectors. Even today, “insurance is arguably one of the most old-fashioned, analog consumer services in existence.”(2) If it works, why change it?

Objective Inefficiency

Information technology is indeed helping the insurance companies reach potential users directly and make better-informed decisions for policy underwriting. These applications of technology, however, are induced primarily by “internal” competition. Everyone in the sector wants a bigger part of the pie and technology provides a way to improve the “façade” of insurance industry.

On the inside, things look a bit different. “Companies are personal heavy, with agents, adjusters and analysts, comprising more than 2 million jobs (US figures). Systems are of the “legacy” type (read antiquated), built around paper documents. The average age of life insurance agents is 59 years old and it is estimated that there are an average of three duplicate processes in each customer sale. The insurance industry is currently relying on a time-consuming, costly and often opaque system. This results in low customer satisfaction, despite heavy marketing investments. (2)

Insurance is About to Get “Blockchainified“

The primary feature of blockchain technology is trust management or, even more accurately, the absence of need for trust management. The Bitcoin network is often described as the “first permanent, decentralized, global and trustless system of records”. Even if you know nothing about the technology, your intuition tells you that insurance (perhaps banking too, wink) might be a good use-case for blockchain technology. Trust your intuition.

Currently, 14 of the top 30 banks are engaging in blockchain proofs-of-concept (PoCs), while 21 of the 63 publicly regulated stock, futures and options exchanges are testing the technology for payments, clearing and settlement (3). Finance and banking are flirting with the idea of consortium and private blockchain PoCs. Transactional efficiency, real-time clearing & settlement, the elimination of third parties and the promise of blockchain programmability (by smart-contracts) are the primary features that attract big finance interest (and money).

There is one vastly important difference between banking/finance and insurance.

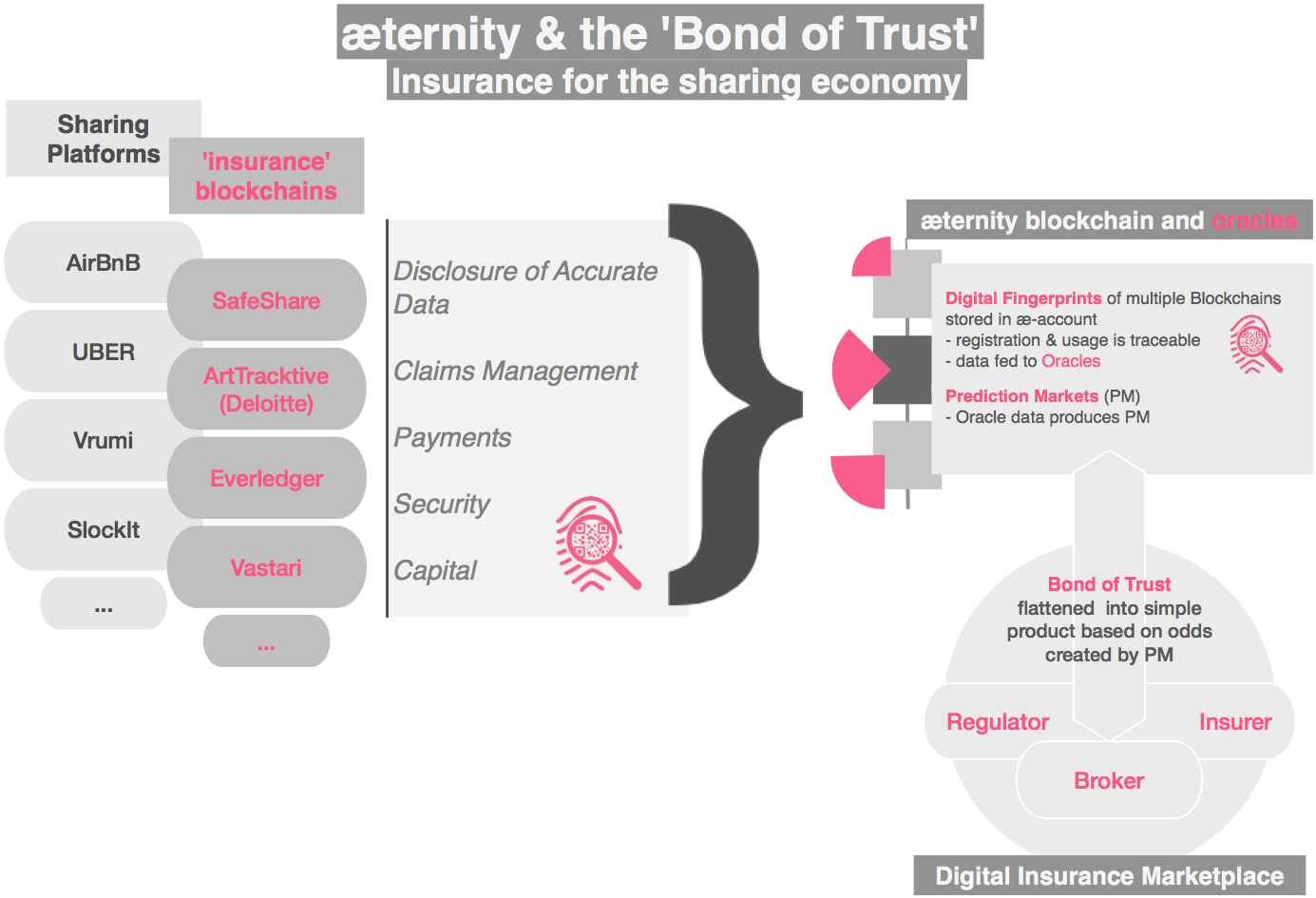

While capital markets or trade finance are based on information asymmetry – an exporter doesn’t share profit margins, for example – insurance demands information disclosure. (3)

Interestingly, the “public” part in “public blockchain” (such as Bitcoin or Ethereum) refers to the fact that all transactions are transparent. If you can identify a network of participants with unique public addresses, you can infer information about their transactions, balance and ability to cover their financial obligations to third parties. There is no need to pay for this information. It is on the public blockchain, free to be used by anyone. Blockchain tech brings high transparency to any on-chain financial operations. Let’s go a bit further.

Blockchain Technology – Prerequisite for a Decentralized Economy

The insurance industry is composed of centralized entities. Decisions on premiums are made by analysts using complex statistical models and various other data. Insurers determine the odds and decide on the amount of their compensations for provision of a “promise to pay”. Does this sound familiar to you? If you are thinking of betting, you are on to something. What insurance companies do is create a bet, set the odds, select triggers and define execution. You know what? Blockchain technology allows for perfect replication of that process.

Blockchain for Insurance

In order for insurance on the blockchain to work, a few features must be technologically achievable:

Identity of the insured. That can be attached to a unique address (a bitcoin address in the case of the Bitcoin blockchain), the private key of which is protected by password and/or 2FA solution. User reputation can be fully managed on the blockchain through digital identities (think electronic signatures). And that’s exactly what the “bookies” (insurers) need.

Insurer/bookie setting the odds. There must be a way of determining the odds of an event occurring and providing that information to users. How about a prediction market? Public blockchain solutions existing today do not offer integrated prediction markets. This service can only be provided by “attached” systems, which leads to increased complexity and inefficiencies, raising the cost of use. In the case of Ethereum, a prediction market service may be provided by Augur or Gnosis. For Bitcoin, HiveMind is considered the most promising project.

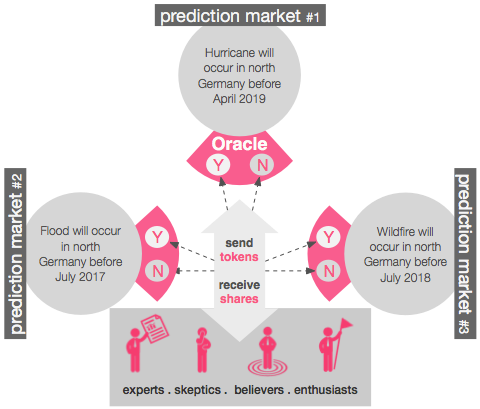

What is a prediction market?

It is a market where users can bet on outcomes and/or set odds for markets their create themselves.

According to Paul Sztorc “Individuals might ‘bet’ on natural disaster, death of an essential leader, election of a ridiculous leader, industry-killing technological innovations, crippling regulatory activities, pandemic, disruptive weather or any other events.”(2) Or anything else!

In the case of blockchain-based prediction markets, the “bookie” or the insurer is anyone willing to bet on the outcome of an event by setting the odds.

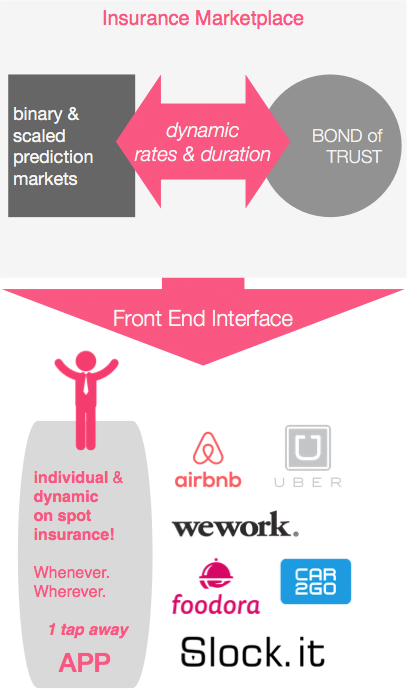

Blockchain technology for prediction markets will change the relationship between risk modeling and underwriting, completely flattening the bond of trust [promise to pay”] into a simple marketplace [or places]. Blockchain-based prediction markets will become the insurance industry.

Immutable contracts. On a blockchain, cryptographically-secured smart contracts eliminate any trust-related risk. If event “X” happens, execution is immediate and irreversible.

Transactional efficiency. Blockchain technology can ensure quick payments and clearing. Nonetheless, some solutions are better in this than others. Scalability continues to be a big issue for the most popular public blockchains.

æternity Blockchain – Tailor-made for Disruption

The æternity blockchain incorporates all features required for a scalable, secure, stable, open and efficient insurance platform.

Prediction markets are incorporated in the consensus mechanism and allow anyone to bet on the outcome of any event or create a market by setting the odds by batting.

Oracles, using prediction markets, enable users to stake valuable digital currency, be rewarded for supporting the correct answer and punished for attempts of manipulation.

State channels enable parallel processing of smart contracts, eliminating scalability concerns for complex user relationships or business logic.

Payment execution can be done off-chain, allowing for transactional speed to be limited only by peer-to-peer bandwidth.

Simply put, the technological opportunities that these powerful features create can potentially make æternity a force of disruption in the insurance industry. Building a proof of concept would be the next logical step.

Would you like to know more?

Read our scientific whitepaper and/or visit our website.

Interested in æternity? Get in touch:

GitHub | Reddit | Telegram | Twitter | Facebook | Mail

References:

(1) CoinDesk. Report: Blockchains for Insurance. CoinDesk. URL

(2) Shipley, Erin and Zhuo, TX. Why the recent hype about insurance tech will be just the beginning. TechCrunch. Jun 6, 2016. URL

(3) CoinDesk. State of Blockchain Q3 2016. CoinDesk. Nov 16, 2016. URL

Leave a Reply